2.14.19

Competing goals: Pay off student loans or save for retirement?

As young adults adapt to living on their own,

they must juggle their student loan payments along with other financial obligations such as rent, food, and transportation.

Link ExampleMany college graduates face a tough decision early in their working lives: pay off student loans or save for retirement. It’s a financial tug of war between digging out from debt today and saving for tomorrow, both of which are very important goals.

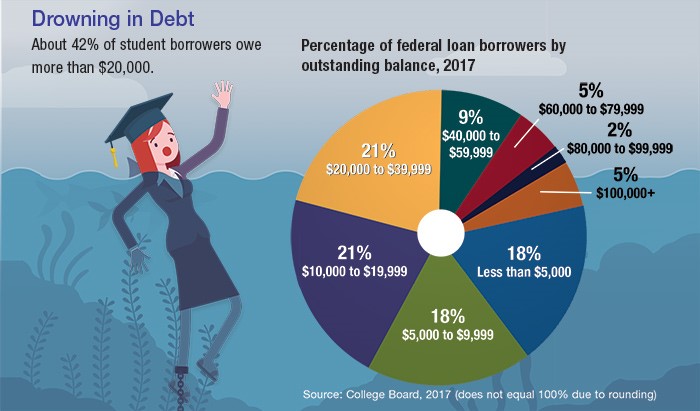

Recent graduates might enter the workforce with little more than their diplomas and student debt averaging about $37,000.1 This equates to a monthly payment of $392, assuming a 5% interest rate and standard 10-year repayment term. (For reference, the 2018–2019 interest rate for undergraduate federal Direct Loans is 5.045%.)

As young adults adapt to living on their own, they must juggle their student loan payments along with other financial obligations such as rent, food, and transportation. Let’s face it, putting aside money now to use in four decades may not seem compelling when loans require immediate attention.

The typical repayment term for student loans is a long 10 years. Waiting until loans are fully paid off before starting to save for retirement can mean missing out on years of potential tax-deferred growth in an employer-sponsored retirement plan or an IRA. If your employer offers a match, consider contributing the minimum amount to get the match, then try to increase your contribution amount as you can.

The one thing young adults have on their side is time, and that time is valuable on the retirement front. Consider two adults: One starts saving $300 a month toward retirement at age 25 for 10 years, and the other starts saving the same amount at age 35 for 10 years. After the 10 years, assume the money simply sits in the account until they reach age 65, earning a 5% annual rate of return. Both adults have contributed the same $46,585 amount, but at age 65 the 25-year-old would have $208,130 and the 35-year-old would have $126,368 — a difference of more than $80,000. (This is a hypothetical example of mathematical principles and is not intended to reflect the actual performance of any specific investment.)

What about paying more toward student loans each month to pay them off faster versus contributing those extra funds to retirement? If the interest rate on a student loan is relatively low, the potential long-term return earned in a retirement account may outweigh the benefits of shaving a year or two off student loans.

Realizing the dilemma that many young employees face, a handful of employers are offering student loan benefits, such as a specific amount toward student loan payments or an enhanced retirement plan match when employees contribute a designated percentage of their salaries toward repaying student loans.2 Watch for these benefits to grow in popularity as student debt impacts an increasing number of young workers.

1) MarketWatch.com, May 12, 2018

2) Employee Benefit News, July 5, 2018

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc.

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

As young adults adapt to living on their own,

they must juggle their student loan payments along with other financial obligations such as rent, food, and transportation.

Link Example