9.5.19

Saving for retirement

Retirement: Building a comfortable lifestyle for tomorrow | September 10, 6-8 p.m.

Join us for this complimentary seminar in Holland. We’ll provide strategies for getting started with successful retirement planning.

- How to calculate the cost of retirement

- Implementing strategies for retirement investing.

- How to manage your retirement portfolio in light of market volatility.

Hosted by Mike Smeenge, CFS* Financial Advisor.

Although most of us recognize the importance of sound retirement planning, few of us embrace the nitty-gritty work involved. With thousands of investment possibilities, complex rules governing retirement plans, and the unpredictable future of consumer prices, most people don’t even know where to begin. Here are some suggestions to help you get started.

Determine your retirement income needs

Depending on your desired retirement lifestyle, you may need anywhere from 60% to 100% of your current income to maintain your current standard of living. But this is only a general guideline. To determine your specific needs, you may want to estimate your annual retirement expenses.

Use your current expenses as a starting point, but note that your expenses may change dramatically by the time you retire. If you’re nearing retirement, the gap between your current expenses and your retirement expenses may be small. If retirement is many years away, the gap may be significant, and projecting your future expenses may be more difficult.

Remember to take inflation into account. The purchasing power of a dollar declines each year as prices rise. And keep in mind that your annual expenses may fluctuate throughout retirement. For instance, if you own a home and are paying a mortgage, your expenses will likely drop if the mortgage is paid off by the time you retire. Other expenses, such as health-related expenses, may increase in your later retirement years. A realistic estimate of your expenses will tell you about how much annual income you may need to live comfortably.

Calculate the gap

Once you have estimated your retirement income needs, take stock of your estimated future assets and income. These may come from Social Security, a retirement plan at work, a part-time job, and other sources. If estimates show that your future assets and income will fall short of what you may need, the rest will have to come from additional personal retirement savings.

Figure out how much you’ll need to save

By the time you retire, you’ll need a nest egg that will provide you with enough income to fill the gap left by your other income sources. But exactly how much is enough? The following questions may help you find the answer:

- At what age do you plan to retire? The younger you retire, the longer your retirement will be, and the more money you’ll need to carry you through it.

- What kind of lifestyle do you hope to maintain during your retirement years?

- What is your life expectancy? The longer you live, the more years of retirement you’ll have to fund.

- What rate of growth can you expect from your savings now and during retirement? Be conservative when projecting rates of return.

- Do you expect to dip into your principal? If so, you may deplete your savings faster than if you just live off investment earnings. Build in a cushion to guard against these risks.

- Build your retirement fund: Save, save, save

When you estimate roughly how much money you’ll need, your next goal is to save that amount. First, you’ll have to map out a savings plan that works for you. Assume a conservative rate of return (which will depend on your risk tolerance), and then determine

approximately how much you’ll need to save every year between now and your retirement to pursue your goal.

The next step is to put your savings plan into action. It’s never too early to get started (ideally, begin saving in your 20s). To the extent possible, you may want to arrange to have certain amounts taken directly from your paycheck and automatically invested in accounts of your choice (e.g., 401(k) plans, payroll deduction savings). This arrangement reduces the risk of impulsive or unwise spending that will threaten your savings plan. If possible, save more than you think you’ll need to provide a cushion.

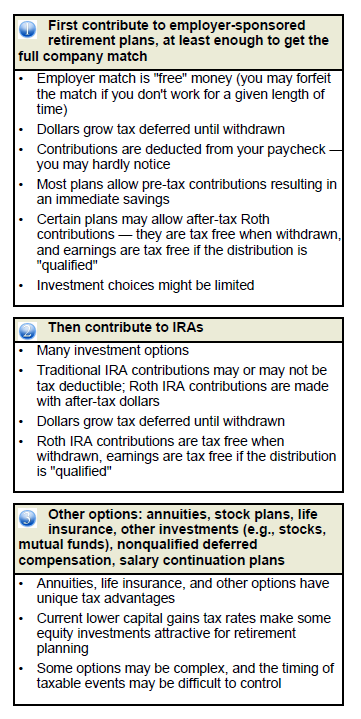

Consider the various savings tools

Consider the various savings tools

Employer-sponsored retirement plans like 401(k)s and 403(b)s are powerful savings tools. Your contributions come out of your salary as pre-tax contributions (reducing your current taxable income) and any investment earnings grow tax deferred until withdrawn. Some 401(k), 403(b), and 457(b) plans also allow employees to make after-tax “Roth” contributions. There’s no up-front tax advantage, but qualified distributions are entirely free from federal income taxes. In addition, employer-sponsored plans often offer matching contributions.

IRAs also feature tax-deferred growth of earnings.

If you are eligible, traditional IRAs may enable you to lower your current taxable income through deductible contributions. Withdrawals, however, are taxable as ordinary income (except to the extent you’ve made nondeductible contributions).

Roth IRAs don’t permit tax-deductible contributions but allow you to make completely tax-free withdrawals under certain conditions. With both types, you can typically choose from a wide range of investments to fund your IRA.

Annuities are generally funded with after-tax dollars, but their earnings grow tax deferred (you pay tax on the portion of distributions that represents earnings). There is also no annual limit on contributions to an annuity. However, withdrawals may be subject to surrender charges.

You have several options for saving for your retirement. Check out this side graphic for some ideas:

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2019

*Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

Retirement: Building a comfortable lifestyle for tomorrow | September 10, 6-8 p.m.

Join us for this complimentary seminar in Holland. We’ll provide strategies for getting started with successful retirement planning.

- How to calculate the cost of retirement

- Implementing strategies for retirement investing.

- How to manage your retirement portfolio in light of market volatility.

Hosted by Mike Smeenge, CFS* Financial Advisor.