5.24.18

How a pension could affect Social Security benefits

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click hereIf you earned a pension while working in private industry, you probably also paid Social Security taxes on your earnings. If that’s the case, the two retirement income streams are independent of each other, and you can enjoy the full benefits of both.

However, if you earned a pension while NOT paying into Social Security (“noncovered employment”) but are eligible for Social Security benefits through other employment or a spouse’s employment, two provisions might reduce your benefits: the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO).

Both of these provisions are intended to adjust for a perceived unfair advantage when Social Security benefit formulas are applied to those who also earned pensions in noncovered employment. The Social Security Administration estimated that about 3.5% of households were affected as of 2014, and the benefit reductions can be substantial.

Federal workers hired after December 31, 1983, are generally not affected by either provision because they paid into Social Security. However, public-sector employees in some states, employees of nonprofit organizations, and workers in foreign countries could be subject to the WEP regardless of hire date. The GPO only affects workers who earned pensions in noncovered federal, state, or local government employment.

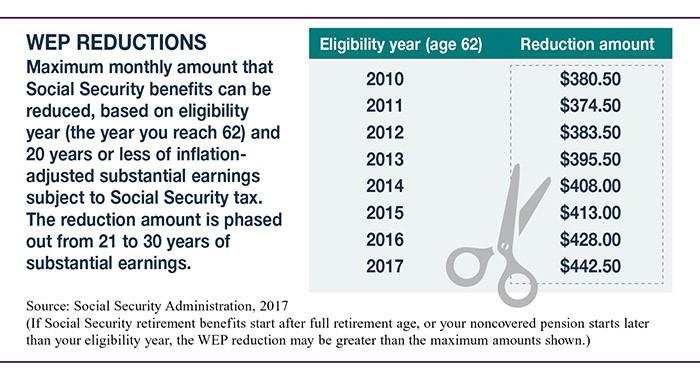

Windfall Elimination Provision

The amount of the WEP benefit reduction depends on the year you turn 62 (eligibility year) and the number of years in which you had “substantial earnings” and paid into Social Security, with the maximum reduction potentially applying for those who paid Social Security taxes for 20 years or less (see table). The reduction cannot be more than one-half of your pension from noncovered employment. Because the WEP reduces your Social Security Primary Insurance Amount (PIA), spousal and dependent benefits based on the PIA may also be reduced. The WEP does not affect survivor benefits.

Government Pension Offset

The GPO may affect spousal or survivor benefits if the spouse or survivor earned a government pension without paying into Social Security. In this case, the GPO may reduce Social Security benefits up to two-thirds of the amount of the pension. For example, if you receive a $900 monthly government pension from noncovered employment and are eligible for a $1,000 monthly Social Security spousal benefit, you would receive only $400 per month from Social Security [$1,000 – $600 (2/3 x $900) = $400]. You would still receive your $900 pension, so your combined benefit would be $1,300.

Rules and calculations for the WEP and the GPO are complex. For additional information, including calculators to estimate the potential reduction, see ssa.gov/planners/retire/wep.html and ssa.gov/planners/retire/gpo.html.

Source: Social Security Administration, 2014, 2017

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc.

Securities offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. Consumers Credit Union are not registered as a broker-dealer. Registered representatives of LPL offer products and services using Consumers Credit Union, and may also be employees of Consumers Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consumers Credit Union. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Consumers Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Consumers Credit Union for these referrals. This creates an incentive for Consumers Credit Union to make these referrals, resulting in a conflict of interest. Consumers Credit Union is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click here