*Interest will continue to accrue during the deferment period. Deferment of payment will extend the life of the loan and may cause an increase in the final payment amount. Offer only available on CONSUMER qualifying loans (excluding: home equities, mortgages, credit cards, lines of credit, MI Saves and merchant loans, Share secured CD secured and repayment accounts) currently financed with Consumers Credit Union with a maximum of six extensions allowed during the term of the loan, and no prior extensions within the last 90 days. Limit of two extensions per rolling 12-month period. Loans must be current and all accounts in good standing. If your auto loan has GAP insurance, please contact your insurance carrier to determine how a Skip A Payment may affect your coverage. If your loan is protected by other insurance, it may be ineligible. Offer subject to approval and does not apply to the first payment of any loan. The fee to skip a payment is $25 for loans originated in Indiana. For all others, the fee is $40 for loan payments less than $500; and $50 for loan payments greater than $500.

Ask questions, explore answers or reach us through one of the ways below.

Alerts help you keep track of your accounts. You can add alerts for low balance, deposits and more. Alerts can be added for checking, savings, loans and credit cards.

To enable alerts:

- Log in to Online Banking

- Click on Manage Alerts from the menu

- Toggle the applicable alert switches for subscription or security alerts

- Set up the parameters of the alert

You can also view Alert History in this section.

Withdrawal limits are in place to protect your account from fraud. Standard daily withdrawals may vary based on your account and products. In general, the standard daily limits are as follows (exceptions apply):

- $2,000 per member in-person at an office or through a TellerPlus+ station; cash limits vary by office

- $1,000 per Consumers ATM

Please ensure checks are endorsed by all parties or your fund availability may be delayed.

Looking to bank on the go? Find our ATM or TellerPlus+ locations here. You can complete many of the same transactions that you would do in an office at our ATMs and TellerPlus+. A list of services and features for each are below.

ATMs

- Open 24/7

- Withdraw cash

- Deposit cash

- Deposit checks

- Balance inquiries (savings and checking accounts)

TellerPlus+ stations

- Extended hours (9 a.m. - 7 p.m. M-F and 9 a.m. - 1 p.m. Sat.)

- Ask account questions

- Make loan payments

- Make credit card payments

- Open new accounts

- Troubleshoot debit card or online banking issues

- Run cash advance

- Determine check availability

- Setup repayment accounts

- Request Skip a Payment

- Transfer money to another member

Online Bill Pay gives you flexibility in how you make payments by controlling when payments are made.

When using Online Bill Pay, we may send your payment out in one of three ways:

- Check – the money will be moved from your account when the payee deposits the check.

- Cashier’s Check – the money will be removed from your account when you initiate the payment.

- ACH – the money will be removed from your account when payment is sent electronically.

To use Bill Pay, log in to Online Banking and follow the registration steps.

From here you can schedule and view payments, manage funding accounts, set up eBills and more. Here are a number of Bill Pay how-to guides to help:

- Bill Pay: How to add a new payee | Add payee on Mobile App

- Bill Pay: Organize your payees

- Bill Pay: How to delete a payee

- Bill Pay: How to set up an AutoPay

- Bill Pay: How to set up an eBill

- Bill Pay: How to schedule a payment | Schedule on Mobile App

You have the convenience to manage your credit cards, including your Cash Back credit card, from within Online Banking, which includes turning your credit card on/off, blocking international usage, enabling transaction controls, setting spending limits and filing disputes.

Learn more by following the steps in this guide.

Learn about other types of credit card alerts.

If you check your credit card balance in Online Banking you may see two different balances: a statement balance and a current balance (outstanding balance). They are often different amounts, especially if you use your credit card daily.

Statement Balance

Your statement balance is the amount you owe on your credit card for the prior month plus any unpaid balances from previous months' activity.

Current Balance

Your current balance includes any recent activity that has posted to your credit card.

To help prevent fraudulent charges and protect your account, our fraud monitoring system sends automated alerts to members when a potentially suspicious transaction is made.

How does it work?

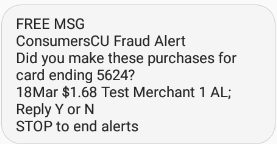

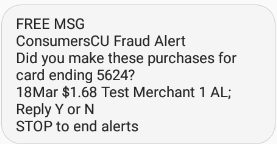

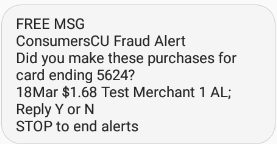

1.) Members with an active cell phone in our system will receive a FREE SMS text message that asks you to validate the charge. The text will look something like this:

2.) You will reply to the message Y or N. Or if you want to opt out of ever seeing these alerts again, reply STOP.

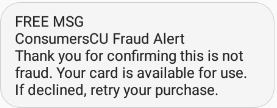

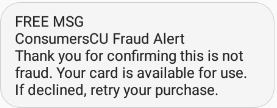

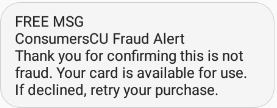

If you Reply Y, that these are your charges, you’ll get a response like this:

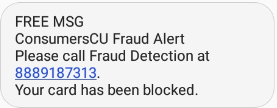

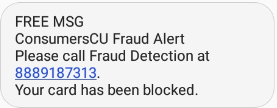

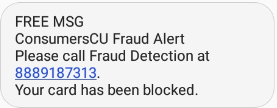

If you Reply N, these aren’t your charges, you’ll get this response and need to call the number indicated:

If you don’t respond to the text, what happens?

It's important to know your card will be temporarily blocked until we receive a response. After the text is sent, our system will attempt to call your cell phone first and then home phone. If neither of those work, we will send you an email to verify the account activity.

This system works great IF we have your right contact information.

Check to see if everything’s up-to-date here in Online Banking. If you don’t have Online Banking, you can enroll now. Or, you can call 800.991.2221 or stop by an office to verify your information.

Federally insured by NCUA

You have the convenience to manage your debit card from within Online Banking, which includes turning your debit card on/off, blocking international usage, enabling transaction controls, setting spending limits and managing alert channels and options.

Learn more by following the steps in this guide.

Direct Deposit is the safest, fastest and most convenient way to get paid.

With Direct Deposit your funds are deposited into your account electronically for immediate use.

There are two ways to set up Direct Deposit:

- Stop by an office—we can help you!

- Talk to the people that pay you—they will need your account number, routing number and signature.

What is Early Pay?

Early Pay is a service that allows qualifying members to access their pending payroll or government payments for a fee up to seven days early through Online Banking.

What is the fee for Early Pay?

There is a fee of $10 per direct deposit under $5,000. For items over $5,000, the fee is $25 per ACH.

How will I know if I qualify?

Eligible members will see Early Pay automatically present itself in Online Banking to access funds early.

If two people from the same household have a joint account and work at the same company, can we choose to release just one of the paychecks early?

No. If both paychecks come from the same employer and go into the same account (e.g., spouses working at the same company with a joint account), they must be released together through Early Pay. You can’t choose to release just one.

*View full disclosure

You may activate eStatements within Online Banking:

- Log in to Online Banking. Click the More Links (...) icon on desktop or the Menu button on mobile.

- Click Documents and Statements.

- Click on the account type and toggle the statement switch from “Paper Only” to Online Statements. Or to change all at once, click on the Paperless Settings tab. Then select the accounts you would like to have eStatements for and click Save.

- A confirmation box will appear. Read and agree to the terms and conditions. Click Accept & Continue.

If a transaction has posted to your account without your authorization you may dispute it through Consumers Credit Union.

Before you begin a dispute, ensure the transaction is unauthorized. Some merchants’ names may appear differently in the transaction history.

Once you have started the dispute process, we will research your claim by contacting the merchant. We may need to speak with you during the process to ask clarifying questions.

Debit Card, Credit Card, ACH and Check Disputes – You may visit an office or call our Member Service Center at 800.991.2221.

Credit Card disputes can also be made within Online Banking:

- Log in to Online Banking On your main dashboard, click the Credit Card Tile.

- Under the Activity tab, click on the transaction that is suspicious.

- In the expanded transaction window, click Dispute.

- Follow the on-screen prompts.

Don't forget, as a Consumers member you qualify for Mastercard®'s free ID Theft Protection™ program that can help monitor card activity for potential fraud. Learn more and how to enroll here.

Resetting you Online Banking username or password is easy!

Reset Username:

- Click here

- Click Forgot your username or password? (link at the bottom of the box)

- Select either the Email or Phone Number delivery method

- Type in your email address or phone number

Reset Password:

- Click here

- Type in your username and date of birth

- Click Reset Password

- Select a delivery method for a verification code

- Enter in the verification code and click next

- Set up a New Password and click Reset Password

If you are still unable to reset your username or password please give us a call at 800.991.2221 or stop by one of our locations—we can help you!

Both personal and business members are eligible for the Mastercard® ID Theft Protection™ program, which allows you to track your identity risk level and detect potential fraud. If suspicious activity is noticed, you'll be alerted and given steps on how to take action to protect yourself. Should your identity ever be stolen, you'll receive "white glove" treatment from Mastercard experts who will step in and personally help you resolve the matter. You can also monitor other credit card types (e.g., store cards, Visa, Amex) besides your Mastercard.

Follow these steps to sign up:

- Go to MasterCardUS.IDProtectionOnline.Com to enroll

- Click Activate Now

- Enter in your Mastercard card number to qualify

- Click Enroll

- Fill out your Personal Information

- Click Save

- Review your personal information

- Add your Social Security Number and other information to track (optional)

- Turn on credit monitoring by clicking Activate Now on the credit services tab

- Review your risk level, alerts and monitoring on your dashboard as needed or set up alerts

With Mobile Check Deposit all you need is a mobile device and a check. Take a picture of the front and backside of the check, and the money will be deposited into your account. Multiple checks can be deposited at one time.

- Sign the back of the check with your signature and write “For Mobile Deposit Only”

- Log in to the Mobile App

- Click Deposit

- Follow the on-screen instructions

Checks deposited through mobile deposit may be subject to a deposit hold. Please check your Mobile App for funds availability. View this guide or this video for step-by-step instruction on mobile check deposit.

Additionally, businesses may purchase Remote Deposit Check Scanning software and a scanner from us to deposit multiple checks right into their account in Online Banking.

Up to $2,500 may be immediately available after deposit approval. The remaining funds are typically available after a two business day hold. You can deposit up to $15,000 per day. If you need to deposit more than $15,000, please make an appointment to visit an office or ATM. Please ensure check is properly endorsed by all parties. It is recommended to keep the physical check for 60 days, then shred. Refer to the Member Handbook and your online banking member agreement for additional information regarding mobile deposit funds availability.

You will need your Member Number to enroll in Online Banking.

Pick the option below that fits you best:

- New user: I've never used Consumers Online Banking before. Click here to learn how to enroll.

- New business user: I'm a business member and have never used Consumers Online Banking before. Click here to learn how to enroll.

- New Spanish-speaking user: ¿Sabes como usar nuestro banco en línea? Haga clic aquí para obtener instrucciones sobre cómo inscribirse.

Learn more about Online Banking here, including how to download the Mobile App. Have questions? Contact us.

You can pay a Consumers loan from your account at Consumers (internal) or from another financial institution (external). Here's how:

Pay Loan from Internal Account

Pay Loan from External Account

To print transactions from a cash or loan/credit account within Online Banking, follow these steps:

- Click on the account name in the dashboard.

- Click on the Print icon to the right of the account name.

*If you'd like to print more transactions than are appearing, click "Show More" at the bottom of the page before clicking on the print icon.

Turning on push authentication in Online Banking allows you to be notified when there is a login or certain changes (mainly security-related) to your account. More than one device can be enrolled.

To enable or disable these notifications, go to Settings >> Security >> Devices. Options appear when you click on an individual device name.

The Quick Balance widget feature of the Mobile App allows you to quickly view balances of your deposit accounts at just a glance.

Here's how to get it:

- Ensure the latest app version is downloaded.

- Add the Consumers Credit Union - MI widget from your device's operating system dashboard. You may need to scroll or search.

- Once added, you will need to Log in from the widget so your device is registered.

- You will then get a notice your widget has been enrolled.

- Return to find your widget on your home screen. It will appear blank, but will prompt you to edit to select the account(s) you'd like to view.

More about the widget

The available balance shown is time stamped. Log in if you believe a transaction isn't showing as expected. In general, the widget will update shortly after a transaction or transfer occurs.

You can export your account information to Quicken or QuickBooks through Online Banking.

- Log in to Online Banking, and go into your account history

- Click Export

- Select the Quicken/QuickBooks File Format

- Select Date Range

- Click Export

Businesses may purchase Remote Deposit Check Scanning software and a scanner from us and, from the convenience of your home or office, deposit multiple checks right into your account in Online Banking. Small businesses that make deposits on a regular basis with a moderate volume of checks will benefit from this service.

View the how-to guide.

Members can set up a Transfer Code to allow for member-to-member transfers without giving out their personal account information. When a member’s Transfer Code is added to someone else’s account, it will be replaced by an account nickname.

To set up your personal Transfer Code to give to other members:

- Log in Online Banking

- Click the Move Money tab

- From the left menu panel, select Member to Member Accounts

- Click My Code

- Select the account you are creating the code for

- Set a name for your code

- Click Create Code

To view a Spanish version of Online Banking, please click on the circle picture/icon and the word “Español” below the logout button.

Online Banking allows you to transfer money between your accounts at Consumers.

Online Banking:

- Log in to Online Banking

- Click Move Money

- Follow the on-screen prompts

If you want to transfer money from another institution, begin by setting up an external account.

How to set up a recurring transfer

Cancel/Edit a recurring transfer

How to transfer to a loan account

How to transfer to a deposit account

You can easily transfer money to another member. To set up a transfer, you will need the other member’s full account number, type and their last name—or you can use their member's Transfer Code.

Here's how to add and transfer money to a new member account:

- Log in to Online Banking

- Click Move Money

- Click Member to Member Accounts on the left panel menu

- Click Add Member Account

- Choose between Account Number or Transfer Code

- If you choose by Account Number, add the member's last name, account number, checking/savings and choose an account nickname.

- If you choose by Transfer Code, you'll simply enter the code given to you by the other member and make a nickname.

- Click Add Account

Once the member account has been added in Online Banking, it will appear under the list of your personal accounts you can transfer to in the Move Money section.

Need to send money to a friend or someone who isn't yet a Consumers member? Some basic instructions are below on how to use your Consumers Mastercard® debit or credit card to send and receive funds on some common social payment platforms.*

- Find and download the Venmo app in the App Store® or Google Play™ store.

- Create an account.

- Under Payment Methods, add your Consumers account or Mastercard debit and credit card information. Please note: Sending money with a debit card is free, while a 3% fee applies to credit cards.

- Search for other Venmo users to start sending and requesting money using your digital wallet.

If you already have a PayPal account …

- Log in to your account and select Wallet.

- Click “Link a card or bank,” and enter your Consumers account or Mastercard information.

- After verifying your billing address, you’re all set!

If you’re new to PayPal …

- Visit the PayPal website and click Sign Up.

- Create an account, and you’re ready to go.

If you already have a Cash App account ...

- Log in to your account and click Linked Accounts.

- Enter your Consumers account or Mastercard information.

If you’re new to Cash App …

- Download the app and visit the Cash App website.

- Steps to send a payment are found here.

If you already have a Google Pay™ account ...

- Open Google Pay.

- Select card option in the upper right corner of your screen (this is a picture of your card).

- Select Add Card at the bottom of your screen, then follow instructions.

If you’re new to Google Pay …

- Download the Google Pay app.

- Open the app and follow the setup instructions.

To use Apply Pay with iOS devices …

- In the Wallet app, tap the Add button.

- Tap Debit or Credit Card.

- Tap Continue.

- Follow the steps on the screen to add a new card.

To use Apple Cash with iOS devices …

- Open the Settings app on your iPhone or iPad.

- Scroll down and tap Wallet & Apple Pay.

- Turn Apple Cash on.

- Under Payment Cards, tap Apple Cash.

- Tap Continue, then follow the instructions on your screen.

Zelle is now only available through participating banks and credit unions. Read details. Consumers does not partner with Zelle.

Please note: Consumers is not affiliated, associated, authorized, endorsed by, or in any way officially connected with PayPal, Venmo, Cash App, Google Pay, Apple Pay, Apple Cash or Zelle. All product and company names are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

You can transfer money to accounts you own at another financial institution. These transfers can only be initiated through our Online Banking. A fee is assessed for any transfer to another financial institution. Please see our Schedule of Fees for more information. There is no fee to transfer money into your Consumers Credit Union account.

Online Banking

- Log in to Online Banking

- Click Move Money

- Select the account you want to transfer From

- Select the external account to want to transfer To

- Enter the Amount

- Select how often the transfer occurs

- Select when the transfer will occur

- Click Review

- Click Confirm

View the complete guide here.

How to set up external accounts - English

How to set up external accounts - Spanish

A Travel Notice should be placed on your account whenever you are traveling outside of your normal travel area. This notice will allow your debit or credit card to work without interruption. Without a travel notification, you may find your debit or credit card blocked by our anti-fraud system.

You can place a Travel Notice by visiting an office, calling our Member Service Center at 800.991.2221 or using Online Banking.

To enter a Travel Notice in Online Banking:

- Log in to Online Banking

- Click More (...)

- Click Travel Notice

- Follow the on-screen prompts

The form also lets you easily add multiple cards to a trip, as well as view, edit and cancel scheduled travel notices.

If your debit or credit card is declined while you’re traveling, please call the number on the back of the card for immediate service.

For extra account security, you can add a second layer of verification to your Online Banking account.

- Download the Google Authenticator Application on your phone. Do NOT set up yet.

- Log in to Online Banking.

- Go to your Profile Icon and click Security.

- Select the Authentication tab.

- Click on Set Up under the Google Authenticator section.

- Use the Delivery Method drop-down to choose your preferred code delivery method.

- Click Request Code.

- A code will be sent to your preferred delivery method; enter the code into Verification Code and click Next.

- Open your Google Authenticator App and click Get started.

- Choose either Scan a QR code or Enter a setup key, depending on your preference. If you select Scan a QR code, you may need to allow camera permissions for the app.

- When prompted, scan the QR barcode or enter in the Code showing in your Online Banking.

- After scanning the QR code or completing the manual entry, Google Authenticator will provide a 6-digit code. Enter this code into Online Banking under Verification Code.

The code is on a timer and will update every 15 seconds. - Click Submit.

- Click Save.

To view the complete how-to guide, click here.

Voice Access allows you to bank by phone.

- Call 800.991.2221

- Select option 2

- Follow the voice prompts

Click here to learn how to make and collect business account payments in Online Banking.

Consumers Credit Union offers a variety of services for new and established businesses, including:

- Lending

- Small Business Administration (SBA) Lending

- Checking and Savings accounts

- Certificates of Deposit (CDs) and Money Market Accounts

- Credit Cards

- Online Banking and Mobile App

- Merchant Services

- ACH Payments and Collections

- Payroll

- Investment Services

- Bill Pay

Please visit our Business Services page for more information.

Businesses may purchase Remote Deposit Check Scanning software and a scanner from us and, from the convenience of your home or office, deposit multiple checks right into your account in Online Banking. Small businesses that make deposits on a regular basis with a moderate volume of checks will benefit from this service.

View the how-to guide.

Your account number can be found on your statement, eStatement or in Online Banking.

- Log in to Online Banking.

- Click on the account name or tile.

- Click Details.

The Consumers routing number is #272481839.

You can activate a debit card, credit card or cash back credit card in these ways:

- Activate in Online Banking by clicking on the card name, then the Activate button on the "Card Services" tab. (You can also add your card to your digital wallet in the same area.)

- Call the number on the sticker located on the front of your new card.

If you need further assistance, please call our Member Service Center at 800.991.2221 or stop by an office.

Alerts help you keep track of your accounts. You can add alerts for low balance, deposits and more. Alerts can be added for checking, savings, loans and credit cards.

To enable alerts:

- Log in to Online Banking

- Click on Manage Alerts from the menu

- Toggle the applicable alert switches for subscription or security alerts

- Set up the parameters of the alert

You can also view Alert History in this section.

A Certificate of Deposit, or CD, is a special type of savings account that holds your money for a specific amount of time with an Annual Percentage Yield (APY) that is typically higher than a standard Savings account. A main difference with a CD is that, typically, a withdrawal during the term will incur a penalty.

When the CD reaches the end of its specific term (example: 36 months), the CD “matures.” Starting on the date of maturity, you have 10 days to withdraw, move or create a new CD without penalty. This is called a “grace period.”

If you do not act within the grace period, the CD will roll over and lock into a new CD. This new CD will keep the same term as the previous CD, but the rate will be adjusted to reflect the current rate offered by Consumers Credit Union. This rate may be lower or higher than your previous rate.

In online banking your can customize your dashboard including changing the order of your accounts. Click here to learn how.

Christmas Savings accounts make budgeting for next year’s holiday expenses easier. Make saving automatic by setting up recurring transfers and be worry-free next holiday season. You can access your Christmas Savings between October 1 and December 31 via Online Banking for your shopping convenience.

Set up you Christmas Savings account online, stop by an office, or give us a call at 800.991.2221.

Courtesy Pay taps into your Overdraft Privilege and overdraws your account to pay items that would otherwise be returned. A Courtesy Pay Fee is assessed for each transaction in which this happens.

We may refuse Courtesy Pay for any item that is beyond your Overdraft Privilege limit.

Courtesy Pay Fees can be avoided by monitoring your accounts and ensuring you have funds available when making purchases.

Please see our Schedule of Fees for our current Courtesy Pay Fee amount.

To help prevent fraudulent charges and protect your account, our fraud monitoring system sends automated alerts to members when a potentially suspicious transaction is made.

How does it work?

1.) Members with an active cell phone in our system will receive a FREE SMS text message that asks you to validate the charge. The text will look something like this:

2.) You will reply to the message Y or N. Or if you want to opt out of ever seeing these alerts again, reply STOP.

If you Reply Y, that these are your charges, you’ll get a response like this:

If you Reply N, these aren’t your charges, you’ll get this response and need to call the number indicated:

If you don’t respond to the text, what happens?

It's important to know your card will be temporarily blocked until we receive a response. After the text is sent, our system will attempt to call your cell phone first and then home phone. If neither of those work, we will send you an email to verify the account activity.

This system works great IF we have your right contact information.

Check to see if everything’s up-to-date here in Online Banking. If you don’t have Online Banking, you can enroll now. Or, you can call 800.991.2221 or stop by an office to verify your information.

Federally insured by NCUA

You have the convenience to manage your debit card from within Online Banking, which includes turning your debit card on/off, blocking international usage, enabling transaction controls, setting spending limits and managing alert channels and options.

Learn more by following the steps in this guide.

Debit cards are automatically reissued and will be sent out mid-month on the month your card expires. Your current debit card will work through the final day of the expiration month.

When you make a purchase with your debit card, a hold is placed on the funds. This is called a “pending transaction.” The transaction “posts” when the funds are moved from your account to the accounts of the merchant.

When a transaction posts to your account the system will consider your available balance. If the available balance (current balance less pending transactions) is negative, a fee may be assessed and the item may or may not be paid, dependent upon Overdraft Protection, account history, and Overdraft Privilege settings. For more information, please visit an office or call our Member Service Center at 800.991.2221.

eStatements offer an extra layer of security and convenience. With eStatements, your monthly statement is saved within Online Banking. You will receive an email each month when your statement is ready. Best of all, eStatements are free!

You may activate eStatements within Online Banking:

- Log in to Online Banking. Click the More Links (...) icon on desktop or the Menu button on mobile.

- Click Documents and Statements.

- Click on the account type and toggle the statement switch from “Paper Only” to Online Statements. Or to change all at once, click on the Paperless Settings tab. Then select the accounts you would like to have eStatements for and click Save.

- A confirmation box will appear. Read and agree to the terms and conditions. Click Accept & Continue.

Please see our Schedule of Fees.

If a transaction has posted to your account without your authorization you may dispute it through Consumers Credit Union.

Before you begin a dispute, ensure the transaction is unauthorized. Some merchants’ names may appear differently in the transaction history.

Once you have started the dispute process, we will research your claim by contacting the merchant. We may need to speak with you during the process to ask clarifying questions.

Debit Card, Credit Card, ACH and Check Disputes – You may visit an office or call our Member Service Center at 800.991.2221.

Credit Card disputes can also be made within Online Banking:

- Log in to Online Banking On your main dashboard, click the Credit Card Tile.

- Under the Activity tab, click on the transaction that is suspicious.

- In the expanded transaction window, click Dispute.

- Follow the on-screen prompts.

Don't forget, as a Consumers member you qualify for Mastercard®'s free ID Theft Protection™ program that can help monitor card activity for potential fraud. Learn more and how to enroll here.

Call our Member Service Center at 800.991.2221, or stop by an office and we can freeze or close your lost or stolen card.

Are there purchases you don’t recognize? We can help you dispute unauthorized transactions and give you back your peace of mind.

Our offices offer instant-issue debit cards, so your debit card replacement is only an office visit away. Replacement card may be subject to a fee.

Both personal and business members are eligible for the Mastercard® ID Theft Protection™ program, which allows you to track your identity risk level and detect potential fraud. If suspicious activity is noticed, you'll be alerted and given steps on how to take action to protect yourself. Should your identity ever be stolen, you'll receive "white glove" treatment from Mastercard experts who will step in and personally help you resolve the matter. You can also monitor other credit card types (e.g., store cards, Visa, Amex) besides your Mastercard.

Follow these steps to sign up:

- Go to MasterCardUS.IDProtectionOnline.Com to enroll

- Click Activate Now

- Enter in your Mastercard card number to qualify

- Click Enroll

- Fill out your Personal Information

- Click Save

- Review your personal information

- Add your Social Security Number and other information to track (optional)

- Turn on credit monitoring by clicking Activate Now on the credit services tab

- Review your risk level, alerts and monitoring on your dashboard as needed or set up alerts

Mastercard True Name is a debit and credit card feature that lets card users choose the first name that appears on their cards. It is meant for nonbinary and transgender people and other members of the LGBTQIA+ community whose preferred or chosen name doesn't match their legal name.

This feature is not meant for nicknames.

Here are a few things to keep in mind about the Mastercard True Name debit and credit card option:

- Your cards will automatically renew with your legal name. Contact Consumers to have your card reissued with your preferred name.

- Consumers partners, including fraud monitoring and after-hours assistance, will not have access to your chosen True Name on file and will address you by your legal name on record.

- When an ID is required at some merchants, there could be friction if the two don’t match.

We offer a Mobile App for iOS and Android devices. You may download them for free from your device’s app store.

Consumers Credit Union is Federally Insured by the NCUA. Your funds or deposits are federally insured and backed by the full faith and credit of the U.S. Government.

The NCUA insures up to $250,000 per member, per institution, per ownership category. “Ownership category” refers to account type, usually single or joint. If you have a single and a joint account at the same institution, both are insured separately up to the $250,000 limit. If you have multiple accounts within the same ownership structure at the same institution, funds will be calculated in aggregate up to the coverage limit noted in the respective category below.

The table below summarizes the account categories that are insured and the applicable coverage amount for each.

| Insured Account Category | Coverage Limit |

| Single Ownership Accounts (owned by one person with no beneficiaries) | Up to $250,000 per Owner |

| Joint Ownership Accounts (owned by two or more persons with no beneficiaries) | Up to $250,000 per Co-owner |

| Certain Retirement Accounts (e.g., traditional IRAs, Roth IRAs) | Up to $250,000 per Owner |

| Revocable Trust Accounts and Personal Accounts with Beneficiaries (e.g., Living/Family Trust accounts, Payable on Death (POD) accounts, In Trust For (ITF) accounts) | Up to $250,000 per Owner/Grantor, per Unique Beneficiary |

| Corporation/Partnership/Unincorporated Association Accounts | Up to $250,000 per Corporation, Partnership or Unincorporated Association |

| Irrevocable Trust Accounts | Up to $250,000 for the Noncontingent Interest of Each Unique Beneficiary |

| Government Accounts (accounts owned by federal, state, local or Indian tribe governments) | Up to $250,000 per Official Custodian (more coverage available subject to specific conditions) |

For more information please visit Share Insurance | MyCreditUnion.gov and the insurance estimator https://www.mycreditunion.gov/insurance-estimator

Friendly faces await you at every office! Click here to find the office most convenient for you.

Our Online Banking system offers 24/7 banking. You can open new accounts, transfer money, make payments, view transaction history, update contact information and much more.

You will need your member number to enroll in Online Banking.

- Click here

- Complete the enrollment steps

- Click Submit

If you have not placed an order for checks in the past, please stop by an office or call the Member Service Center at 800.991.2221 to place your first order.

If you have previously placed a check order with us, you can reorder checks through Online Banking.

To reorder checks through Online Banking:

- Log in to Online Banking

- Click on the Checking Account you’re ordering checks for

- Click Details & Settings

- Click Order Checks

- You will be taken to a third-party site to order your checks

- Follow the on-screen prompts

Overdraft Privilege allows you to draw your account into the negative to pay for items you need or bills that must be paid. Whenever a transaction uses your Overdraft Privilege, a Courtesy Pay fee is assessed. Please see our Schedule of Fees for more information.

Every time you use your Consumers Credit Union debit Mastercard®, you can choose to have your purchases rounded up to the nearest dollar—and the difference can go right to your savings or can be donated to a charity in your community.

Want to split your change between your savings and a local charity? We can do that! Small change, big impact!

How do I register?

From the Everyday Impact dashboard inside Online Banking, you can enroll your debit card for round ups. If you are already enrolled in charitable round ups, you can simply edit your settings to enroll. You will be able to designate your round up to be transferred to a savings account or round up for charitable giving. You may also choose to split that round-up to go to both savings and a charitable cause.

Why would I want to round up to save or donate?

Rounding up transactions to your savings account offers an effortless way to save while cultivating healthy savings habits. This method supports you in reaching your financial goals and enhances your overall financial wellness.

Our program also enables you to allocate round ups for greater charitable impact. You can decide how much of your round ups go toward your future goals and how much goes to supporting those in need. By activating round ups, you can build a more secure financial future for yourself and support the causes you care about.

A routing number, also known as the transit or ABA number, is a number that identifies Consumers Credit Union to other financial institutions within the United States.

The routing number for Consumers Credit Union is 272481839.

For those with Serious Interest Checking® Accounts, a monthly requirement tracking widget is viewable in the dashboard section of your Online Banking. It will show where you stand in maintaining the $1,000 average daily balance, $1,000 direct deposit, eStatements and 12 posted debit card or credit card transaction requirements each month in order to earn 4.00% APY.*

For those with Serious Interest Checking® Accounts, a monthly requirement tracking widget is viewable in the dashboard section of your Online Banking. It will show where you stand in maintaining the $1,000 average daily balance, $1,000 direct deposit, eStatements and 12 posted debit card or credit card transaction requirements each month in order to earn 4.00% APY.*

*APY = Annual Percentage Yield. Limit one Serious Interest Checking account per Social Security number. Rates are accurate as of [date-today format='F j, Y']. Rates are variable and subject to change at any time without notice. Please see www.consumerscu.org/personal/banking/checking/serious-interest-checking for more information. Federally insured by NCUA.

A Stop Payment may be placed on a check you have written or on any checks that have been lost or stolen.

You may place a stop payment in one of three ways:

- Stop by any office

- Call our Member Service Center at 800.991.2221

- Log in to Online Banking

To place a Stop Payment through Online Banking:

- Log in to Online Banking

- Click More (...)

- Click Stop Payment

- Follow the on-screen prompts

A Stop Payment fee may apply. Please see our Schedule of Fees for more information.

Need to send money to a friend or someone who isn't yet a Consumers member? Some basic instructions are below on how to use your Consumers Mastercard® debit or credit card to send and receive funds on some common social payment platforms.*

- Find and download the Venmo app in the App Store® or Google Play™ store.

- Create an account.

- Under Payment Methods, add your Consumers account or Mastercard debit and credit card information. Please note: Sending money with a debit card is free, while a 3% fee applies to credit cards.

- Search for other Venmo users to start sending and requesting money using your digital wallet.

If you already have a PayPal account …

- Log in to your account and select Wallet.

- Click “Link a card or bank,” and enter your Consumers account or Mastercard information.

- After verifying your billing address, you’re all set!

If you’re new to PayPal …

- Visit the PayPal website and click Sign Up.

- Create an account, and you’re ready to go.

If you already have a Cash App account ...

- Log in to your account and click Linked Accounts.

- Enter your Consumers account or Mastercard information.

If you’re new to Cash App …

- Download the app and visit the Cash App website.

- Steps to send a payment are found here.

If you already have a Google Pay™ account ...

- Open Google Pay.

- Select card option in the upper right corner of your screen (this is a picture of your card).

- Select Add Card at the bottom of your screen, then follow instructions.

If you’re new to Google Pay …

- Download the Google Pay app.

- Open the app and follow the setup instructions.

To use Apply Pay with iOS devices …

- In the Wallet app, tap the Add button.

- Tap Debit or Credit Card.

- Tap Continue.

- Follow the steps on the screen to add a new card.

To use Apple Cash with iOS devices …

- Open the Settings app on your iPhone or iPad.

- Scroll down and tap Wallet & Apple Pay.

- Turn Apple Cash on.

- Under Payment Cards, tap Apple Cash.

- Tap Continue, then follow the instructions on your screen.

Zelle is now only available through participating banks and credit unions. Read details. Consumers does not partner with Zelle.

Please note: Consumers is not affiliated, associated, authorized, endorsed by, or in any way officially connected with PayPal, Venmo, Cash App, Google Pay, Apple Pay, Apple Cash or Zelle. All product and company names are trademarks or registered trademarks of their respective holders. Use of them does not imply any affiliation with or endorsement by them.

A Travel Notice should be placed on your account whenever you are traveling outside of your normal travel area. This notice will allow your debit or credit card to work without interruption. Without a travel notification, you may find your debit or credit card blocked by our anti-fraud system.

You can place a Travel Notice by visiting an office, calling our Member Service Center at 800.991.2221 or using Online Banking.

To enter a Travel Notice in Online Banking:

- Log in to Online Banking

- Click More (...)

- Click Travel Notice

- Follow the on-screen prompts

The form also lets you easily add multiple cards to a trip, as well as view, edit and cancel scheduled travel notices.

If your debit or credit card is declined while you’re traveling, please call the number on the back of the card for immediate service.

If you deposited a check in an office or through an ATM/Interactive Teller, you can click on the deposit in transaction history within Online Banking to view your check.

If you used remote deposit through the Mobile App, please stop in an office or call the Member Service Center at 800.991.2221 to get a check image.

A check copy fee may apply. Please see our Schedule of Fees for more information.

You can activate a debit card, credit card or cash back credit card in these ways:

- Activate in Online Banking by clicking on the card name, then the Activate button on the "Card Services" tab. (You can also add your card to your digital wallet in the same area.)

- Call the number on the sticker located on the front of your new card.

If you need further assistance, please call our Member Service Center at 800.991.2221 or stop by an office.

You can add email and/or text alerts for credit card activity.

- Log in to Online Banking

- Click Manage Alerts

- Click Account Alerts

- Click Cards (under the Account Alerts title)

- Select the credit card you'd like to receive an alert on

- Toggle the applicable alert switches

- Set up the parameters of the alert

Automated debit and credit card fraud alerts

To help prevent fraudulent charges and protect your account, our fraud monitoring system sends free automated alerts to members when a potentially suspicious transaction is made.

How does it work?

1.) Members with an active cell phone in our system will receive a FREE SMS text message that asks you to validate the charge.

2.) You will reply to the message Y or N. Or if you want to opt out of ever seeing these alerts again, reply STOP.

If you don’t respond to the text, what happens?

It’s important to know your card will be temporarily blocked until we receive a response. After the text is sent, our system will attempt to call your cell phone first and then home phone. If neither of those work, we will send you an email to verify the account activity.

This system works great IF we have your right contact information.

Check to see if everything’s up-to-date here in Online Banking. If you don’t have Online Banking, you can enroll now. Or, you can call 800.991.2221 or stop by an office to verify your information.

You can transfer balances from credit cards at other institutions to your Consumers Mastercard® credit card. You’ll probably save money in the process!

To transfer a balance, you'll need to submit a request through Online Banking:

- Log in to Online Banking.

- On your main dashboard, click on the credit card tile or account name.

- Click on the Card Services tab.

- Click on the Balance Transfer button.

- Complete the form with the other financial institution’s information and click Next to send off the information.

You should see the adjustment to your balance made within 24 hours. Once we send a check, you will see that amount posted to your credit card balance.

View the complete how-to guide here.

You have the convenience to manage your credit cards, including your Cash Back credit card, from within Online Banking, which includes turning your credit card on/off, blocking international usage, enabling transaction controls, setting spending limits and filing disputes.

Learn more by following the steps in this guide.

Learn about other types of credit card alerts.

Your credit card will appear as a tile on your main dashboard in Online Banking. When you click on the card's name, you will be taken to the credit card maintenance screen.

On this screen you can:

- View transactions

- View balances

- View and redeem rewards (if applicable)

- Lock/unlock your card

- Block certain transaction types

- Set spending limits

- Consolidate balances

- Set travel notices

- Request a new card

If you check your credit card balance in Online Banking you may see two different balances: a statement balance and a current balance (outstanding balance). They are often different amounts, especially if you use your credit card daily.

Statement Balance

Your statement balance is the amount you owe on your credit card for the prior month plus any unpaid balances from previous months' activity.

Current Balance

Your current balance includes any recent activity that has posted to your credit card.

To help prevent fraudulent charges and protect your account, our fraud monitoring system sends automated alerts to members when a potentially suspicious transaction is made.

How does it work?

1.) Members with an active cell phone in our system will receive a FREE SMS text message that asks you to validate the charge. The text will look something like this:

2.) You will reply to the message Y or N. Or if you want to opt out of ever seeing these alerts again, reply STOP.

If you Reply Y, that these are your charges, you’ll get a response like this:

If you Reply N, these aren’t your charges, you’ll get this response and need to call the number indicated:

If you don’t respond to the text, what happens?

It's important to know your card will be temporarily blocked until we receive a response. After the text is sent, our system will attempt to call your cell phone first and then home phone. If neither of those work, we will send you an email to verify the account activity.

This system works great IF we have your right contact information.

Check to see if everything’s up-to-date here in Online Banking. If you don’t have Online Banking, you can enroll now. Or, you can call 800.991.2221 or stop by an office to verify your information.

Federally insured by NCUA

Debit cards are automatically reissued and will be sent out mid-month on the month your card expires. Your current debit card will work through the final day of the expiration month.

Credit card eStatements are separate from your other account eStatements.

To enroll in credit card eStatements:

- Log in to Online Banking.

- Click the More Links (...) icon on desktop or the Menu button on mobile.

- Click Documents and Statements.

- Click on the Credit Card Accounts tab and toggle the statement switch from “Paper Only” to Online Statements. Or you can change all of your accounts at once, by clicking on the Paperless Settings tab and then selecting the accounts you would like to have eStatements for and click Save.

- A confirmation box will appear. Read and agree to the terms and conditions. Click Accept & Continue.

If a transaction has posted to your account without your authorization you may dispute it through Consumers Credit Union.

Before you begin a dispute, ensure the transaction is unauthorized. Some merchants’ names may appear differently in the transaction history.

Once you have started the dispute process, we will research your claim by contacting the merchant. We may need to speak with you during the process to ask clarifying questions.

Debit Card, Credit Card, ACH and Check Disputes – You may visit an office or call our Member Service Center at 800.991.2221.

Credit Card disputes can also be made within Online Banking:

- Log in to Online Banking On your main dashboard, click the Credit Card Tile.

- Under the Activity tab, click on the transaction that is suspicious.

- In the expanded transaction window, click Dispute.

- Follow the on-screen prompts.

Don't forget, as a Consumers member you qualify for Mastercard®'s free ID Theft Protection™ program that can help monitor card activity for potential fraud. Learn more and how to enroll here.

If you already have a credit card with us, you can request an increase to your credit card limit by stopping by an office or over the phone at 800.991.2221.

If your credit card is lost or stolen, please visit an office or call our Member Service Center at 800.991.2221.

To temporarily lock your credit card in Online Banking:

- Log in to Online Banking.

- On your main dashboard, click View Account on the credit card tile.

- Click the Details tab.

- Near the credit card image, move the toggle to the right to lock your card.

To request a new credit card:

- Give us a call at 800.991.2221 or stop by one of our locations.

Learn how to set up credit card controls here.

Don't forget, as a Consumers member you also qualify for Mastercard®'s free ID Theft Protection™ program that can help monitor card activity for potential fraud. Learn more and how to enroll here.

You have several convenient ways to pay your credit card, loan or mortgage:

- Online Banking: Transfer money from a Consumers account

- Visit an office

- Pay at a TellerPlus+ station

- Mail your payment to:

P.O. Box 525 Oshtemo, MI 49077-0525

To pay from a Consumers account in Online Banking:

- Log in to Online Banking

- Click Move Money

- In the From field, select the account you want to use to pay

- In the To field, select your credit card

- Enter the amount

- Click Review Transfer

- Click Confirm Transfer

To pay your loan or mortgage from an external account:

- Log in to Online Banking

- Click Move Money

- In the From field, select the external account you want to use to pay

- In the To field, select your loan

- Enter the amount

- Click Review Transfer

- Click Confirm Transfer

Both personal and business members are eligible for the Mastercard® ID Theft Protection™ program, which allows you to track your identity risk level and detect potential fraud. If suspicious activity is noticed, you'll be alerted and given steps on how to take action to protect yourself. Should your identity ever be stolen, you'll receive "white glove" treatment from Mastercard experts who will step in and personally help you resolve the matter. You can also monitor other credit card types (e.g., store cards, Visa, Amex) besides your Mastercard.

Follow these steps to sign up:

- Go to MasterCardUS.IDProtectionOnline.Com to enroll

- Click Activate Now

- Enter in your Mastercard card number to qualify

- Click Enroll

- Fill out your Personal Information

- Click Save

- Review your personal information

- Add your Social Security Number and other information to track (optional)

- Turn on credit monitoring by clicking Activate Now on the credit services tab

- Review your risk level, alerts and monitoring on your dashboard as needed or set up alerts

What is a mobile wallet and how does it keep transactions safe?

A mobile wallet is a digital version of the physical wallet you carry around. When you add your Consumers debit or credit card to a mobile wallet app, it is assigned a randomly generated 16-digit number, which your phone or smartwatch sends to authorize payment.

Available mobile wallets

Your Consumers debit and credit card can be added to Apple Pay™, Google Pay™ and Garmin Pay™. Please follow your manufacturer’s instructions.

Additionally, within 2-3 days of getting a new or replacement credit card, your card will appear digitally in Online Banking. You can quickly add your card to Apple Pay or Google Pay (depending on your phone type) by simply clicking the "Add to" wallet button on the "Card Services" tab within Online Banking when you click on your card name.

How do I use my mobile wallet?

Once you've added your Consumers debit or credit card to your mobile wallet, you simply hold your smartphone, smartwatch, or other mobile device near a terminal that shows the "contactless" symbol (four curved lines expanding to the right). A passcode or other authentication may be required. Simply enter it and your transaction will be complete.

Is a mobile wallet safe?

Extremely. More secure than using a physical card, a mobile wallet assigns a unique 16-digit number (or token) to your card. No one sees this number, including the store where you're making the purchase, making for a seamless, completely anonymous transaction that hackers can’t touch!

What if I lose my phone or smartwatch?

If you take precautions beforehand, your information should not be compromised, so protect your device by:

- Setting up password or fingerprint protection on your device.

- Using an app that allows you to remotely lock or erase your device's data.

- Deleting your personal information before you sell or recycle your device.

Can a mobile wallet store more than just my card information?

Yes! It can also securely store loyalty cards, gift cards and digital concert or travel tickets.

Why use a mobile wallet?

It can make transactions quicker, it's easier than fumbling for your physical wallet (or realizing that you forgot it!) and it's more secure than a physical card. So the question really is: why not?

Tap & Go™ (formerly Tap & Pay) chip technology, sometimes known as contactless, gives your card greater fraud protection and allows you to either tap, insert or swipe your card when making purchases. Look for this sign ![]() at your favorite merchants and simply tap your card at the reader to pay.

at your favorite merchants and simply tap your card at the reader to pay.

A Travel Notice should be placed on your account whenever you are traveling outside of your normal travel area. This notice will allow your debit or credit card to work without interruption. Without a travel notification, you may find your debit or credit card blocked by our anti-fraud system.

You can place a Travel Notice by visiting an office, calling our Member Service Center at 800.991.2221 or using Online Banking.

To enter a Travel Notice in Online Banking:

- Log in to Online Banking

- Click More (...)

- Click Travel Notice

- Follow the on-screen prompts

The form also lets you easily add multiple cards to a trip, as well as view, edit and cancel scheduled travel notices.

If your debit or credit card is declined while you’re traveling, please call the number on the back of the card for immediate service.

We are proud to offer investment and advisory services thru LPL Financial (LPL)* at Consumers Credit Union.

Please visit our Investment Services page for more information.

*Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA/SIPC). Insurance products are offered through LPL or its licensed affiliates. Consumers Credit Union are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using Consumers Credit Union Investment and Advisory Services, and may also be employees of Consumers Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consumers Credit Union. Securities and insurance offered through LPL or its affiliates are:

[table id=3 /]

We follow Best Score pricing! Rates are based on the best credit score between all co-borrowers with pricing based off the highest score.

Budgeting biweekly can help you pay off your loan faster—and you’ll pay less interest! By budgeting biweekly, you can save up to make 13 payments in a year instead of 12.

To save up for additional payments, check out our guide by clicking here.

Michigan: LH244329

Arizona: 381438667

California: ESL

Colorado: E3814386670001

Florida: 0242801153

Georgia: 001110900758

Idaho: 381438667

Illinois : DA0169IL

Indiana: 3814386670001

Iowa: 38143866700

Kansas: 381438667

Louisiana: EKCJ

Maryland: 0000005765

Massachusetts: C 25228

Nebraska: 21389680

Nevada: CZ0071

New Jersey: DA0169NJ

New York: 80408

North Carolina: 000025685381

Ohio: E08648

Pennsylvania: 38143866701

South Carolina: 34164159

South Dakota: 381438667

Texas: 38143866700

Virginia: CCU84

Washington: CAM

West Virginia: DA0169WV

Wisconsin: 00125342

A lien release is mailed to you upon your loan being paid in full. If you paid your vehicle off with a check, the lien release will not be mailed until funds have been received and the check has cleared.

If you have misplaced your lien release or it was lost in the mail, we offer two options:

- To receive a lien release letter immediately, please visit an office. Please make sure you have your identification and, if possible, your title. (We can sign off for the lienholder in the office.)

- To receive a lien release letter by mail, call our Member Service Center at 800.991.2221.

An appraisal fee covers the cost of having a professional appraiser evaluate a home and estimate its market value. The appraisal fee is collected in conjunction with submitting a signed mortgage disclosure package. Appraisal fees can be paid through the custom link provided in an email from your mortgage loan officer.

You can pay a Consumers loan from your account at Consumers (internal) or from another financial institution (external). Here's how:

Pay Loan from Internal Account

Pay Loan from External Account

Skip a Pay allows you to skip a loan payment on qualifying loans.

When using Skip a Pay, please keep this in mind:

- A first loan payment is not eligible.

- Skip a Pays may be made every 90 days.

- Skip a Pay can be used on most vehicle loans, recreational loans, and unsecured personal loans. Certain loans are ineligible.

- A Skip a Pay request may be rejected if your loan is not in good standing.

- The skipped payment is moved to the end of the loan. This extends the time you will pay on the loan by one month for each Skip a Pay completed.

You can use Skip a Pay by submitting a request through Online Banking or calling our Member Service Center at 800.991.2221, as some skip requests require manual processing.

To submit a Skip a Pay request in Online Banking:

- Log in to Online Banking

- Click More (...)

- Click Skip a Pay

- Follow the on-screen prompts; the screen will show if any of your current loans are eligible or not

Should a Skip a Pay solution not work for you, please call us to discuss how we can meet your needs.

To maintain security, your Online Banking account may be locked after multiple failed attempts to login. Once your account is locked you will need to call our member service center at 800.991.2221 or stop by an office to unlock it. We will verify your identity before unlocking it.

If you forgot your password, click Forgot Username or Password on the login screen to reset it.

When you open a membership at Consumers you are given a member number that uniquely identifies you as a member of the credit union. You can find your member number at the top right corner of your statement (both paper and electronic).

If your name has recently changed, please stop by one of our locations with documentation that includes your old name and new name. If you are unable to come in give us a call at 800.991.2221 and have your paperwork ready to fax.

Accepted documents include:

- Marriage License

- Divorce Decree (with name change approval signed by a judge)

- Court Issued Documentation

To change your accounts’ nicknames:

- Log in to Online Banking

- Click on the Account

- Click Details

- Click Account Nickname

- Rename your account

- Click Save

To hide your accounts in Online Banking:

- Log in to Online Banking

- Click the pencil icon next to the account type

- Click the eye to hide/unhide an account.

- Click Save

Security Settings can be found in Online Banking.

- Log in to Online Banking

- Click your initials in the top right corner

- Click Security

You can update your contact information through Online Banking, in an office or by calling our Member Service Center at 800.991.2221.

In Online Banking:

- Log in to Online Banking

- Click your initials in the top right corner

- Click on Profile

- Update your contact information

At Consumers, we do all we can to make banking easy and enjoyable for our members—including those who speak Spanish. Whether you prefer to bank in person or online, here are four ways we help our Spanish-speaking members.

1.) In person at our offices

Many Consumers offices have Spanish-speaking staff who can help you with setting up accounts, getting loans or answering questions. To find offices with staff who speak your language, search for “espanol” on ConsumersCU.org.

2.) On the phone

When you call our main customer service number, 800.991.2221, hit the asterisk (*), and you’ll be connected with a staff member who speaks Spanish. These services are available 9 a.m. – 5 p.m. on Monday – Friday.

3.) Website

Access the entire Consumers website in Spanish. At the bottom of the home page (and most other web pages) look for the Google “Select Language” pull-down. Click on the gray arrow and choose Spanish.

4.) Online Banking

To view a Spanish version of Online Banking, please click on the circle picture/icon and the word “Español” below the logout button.

Learn more about how @Work can develop financial fitness for your employees at no cost to your business.

To deposit large amounts of coin, you can either roll it and bring it into an office or use one of our coin machines located at our Centre, 9th Street and South Haven offices.

The following convenience fees will apply with all proceeds going to community impact efforts:

- Members - 5% fee

- Youth members (must have youth savings account) ages 18 and under - free

- Non-members - 10% fee

Each of our office locations offers complimentary document shredding services to our members. Simply place your documents into the locked bin and a Data Guardian shred truck will come to securely destroy the contents.

Monday: 8 a.m. – 7 p.m.

Tuesday: 8 a.m. – 7 p.m.

Wednesday: 8 a.m. – 7 p.m.

Thursday: 8 a.m. – 7 p.m.

Friday: 8 a.m. – 7 p.m.

Saturday: 9 a.m. – 1 p.m.

Sunday: Closed

Consumers Credit Union is Federally Insured by the NCUA. Your funds or deposits are federally insured and backed by the full faith and credit of the U.S. Government.

The NCUA insures up to $250,000 per member, per institution, per ownership category. “Ownership category” refers to account type, usually single or joint. If you have a single and a joint account at the same institution, both are insured separately up to the $250,000 limit. If you have multiple accounts within the same ownership structure at the same institution, funds will be calculated in aggregate up to the coverage limit noted in the respective category below.

The table below summarizes the account categories that are insured and the applicable coverage amount for each.

| Insured Account Category | Coverage Limit |

| Single Ownership Accounts (owned by one person with no beneficiaries) | Up to $250,000 per Owner |

| Joint Ownership Accounts (owned by two or more persons with no beneficiaries) | Up to $250,000 per Co-owner |

| Certain Retirement Accounts (e.g., traditional IRAs, Roth IRAs) | Up to $250,000 per Owner |

| Revocable Trust Accounts and Personal Accounts with Beneficiaries (e.g., Living/Family Trust accounts, Payable on Death (POD) accounts, In Trust For (ITF) accounts) | Up to $250,000 per Owner/Grantor, per Unique Beneficiary |

| Corporation/Partnership/Unincorporated Association Accounts | Up to $250,000 per Corporation, Partnership or Unincorporated Association |

| Irrevocable Trust Accounts | Up to $250,000 for the Noncontingent Interest of Each Unique Beneficiary |

| Government Accounts (accounts owned by federal, state, local or Indian tribe governments) | Up to $250,000 per Official Custodian (more coverage available subject to specific conditions) |

For more information please visit Share Insurance | MyCreditUnion.gov and the insurance estimator https://www.mycreditunion.gov/insurance-estimator

Consumers Credit Union is a not-for-profit corporation—an important distinction between Consumers and typical banks, as well as Consumers and nonprofits, such as charities and similar organizations.

Unlike a for-profit bank, Consumers is a credit union, and credit unions are not-for-profit, meaning Consumers does not distribute its profits to stockholders, rather, it is member owned. Consumers functions as any other business, however, the money we receive in deposits primarily goes right back into the communities we serve as mortgages and vehicle, business and other loans. Any profit we do make is invested back in the organization, benefitting our local members with higher interest rates on savings, lower rates on loans and often lower, fewer fees compared to for-profit banks.

That said, Consumers is also different than a nonprofit. Nonprofits are organizations driven by a charitable mission, relying on donations and grants exclusively to support their efforts—think charities, universities, religious organizations. Like credit unions, nonprofits don't seek profits. But that’s where the similarities end. Consumers Credit Union is a robust financial institution that offers all of the personal and business banking products, services and conveniences of a bank while focusing on our members' financial wellness rather than profits.

For-profit? Nonprofit? As a not-for-profit, Consumers Credit Union offers the best of both worlds, and that's the best for your money.

When someone needs to wire money to you from another country, it is important to make sure you give the sender all the information they need. If the information they have is incomplete or wrong, it could delay the money by days or weeks.

Anyone sending money will need the following information from you:

- Institution Name: Consumers Credit Union

- Address: 7200 Elm Valley Drive, Kalamazoo, MI 49009

- Your full name (as Beneficiary of the wire transfer)

- SWIFT/BIC Code: CNRIUS33

- Type of account: Checking or Savings

- Account Number: Full 10-digit account number

Please see our Schedule of Fees for a list of wire transfer fees. Note that Consumers Credit Union is only equipped to receive MT999 messages through the SWIFT network.

A Repayment Plan can offer relief from having to pay back the entire overdrawn balance of your checking account at one time. When establishing a Repayment Plan, your overdrawn checking balance up to your Courtesy Pay limit is set aside to be repaid over four monthly installments that begin one month after the account is established.

Please note: A member must have opted in to overdraft protection and have a negative balance in their checking account before they can request a repay through Online Banking.

How to Set up a Repayment Plan

- Within Online Banking, click on the More links (...) menu option.

- Click Repayment Plan.

- Review the repayment information, filling in any missing fields. You may also choose to set up an automatic transfer to pay back the funds starting the following month by clicking the optional checkbox.

- Acknowledge the disclosure by clicking the checkbox.

- Click Submit.

You may also start a Repayment Plan within an office or by calling our Member Service Center at 800.991.2221.

To redeem a U.S. Savings Bond, please visit one of our offices. You will need:

- Your U.S. Savings Bond

- A picture ID

- SSN (Social Security Number)

*Service available for members only.

A domestic wire transfer is a direct electronic transfer of funds between two accounts at different financial institutions based in the United States. You’ll need some extra information when working with a wire transfer, and we’ve outlined it for you below!

When sending a domestic wire transfer, you will need the following information from the recipient:

- Their Financial Institution’s Information:

- Name

- Address

- Routing Number

- Their Account Information

- Name on the account (as Beneficiary of the wire transfer)

- Account number

When receiving a domestic wire transfer, you’ll need to give the sender this information:

- Consumers Credit Union’s Information:

- Name: Consumers Credit Union

- Address: 7200 Elm Valley Drive, Kalamazoo, MI 49009

- Routing Number: 272481839

- Your Account information:

- Name on the account

- Account number

Domestic wire transfers typically take one business day, but it’s dependent upon when you send the wire as financial institutions have “cut off” times. After the “cut off” time, a wire transfer will not be sent until the following business day. (Weekends and holidays don’t count!) Funds being wired must be on deposit for 5 business days prior to sending.

Please see our Schedule of Fees for a list of wire transfer fees.

- The turnaround time for request completion is within 24 hours Monday through Friday.

- Weekend submittal will be returned back to your provided fax on the following business day.

- Please Note: The form needed for authorization is our form, and this can be found on the submittal page. Any other form will be denied.

- Submitting the request through this portal is free to the third party and our members.

- To submit your request, please click here.

Oftentimes, landlords or government entities will request a Verification of Deposit report for a banking account to verify your income. You may request this through an office, online or by phone for a fee of $10 or you can access a digital copy for yourself free within Online Banking.

To obtain a free digital copy, follow these steps:

- Log in to Online Banking.

- Go to the More (…) links and click Verification of Deposit.

- Select the name of the account needed in the drop-down. If multiple accounts are needed, click Add Another Account.

- Click Create Document.

- A PDF will appear that you can download and save to your computer.

Comments are closed.

Great tips. My wife and I just started to live what we consider to be “frugally”, and we’re constantly on the lookout for new ways to save money without completely sacrificing everything. We’re definitely going to try to sell our old things soon.

An outstanding share! I have just forwarded this onto

a colleague who was doing a little homework on this.

And he in fact bought me breakfast simply because I discovered

it for him… lol. So let me reword this…. Thank YOU for the meal!!

But yeah, thanks for spending some time to talk about this topic here on

your web page.

When you build new headquarters in the Groves, will you have safety deposit boxes there?

Hi Judy, great question! We are not currently planning on it, but we do have them at our Milwood Office in Kalamazoo and our South Haven Office.

The Interactive tellers are A Excellent addition to the Credit Union. These are Very User Friendly and can take care of all of your needs. The staff behind the Interactive teller, as well as the Staff assisting in the lobby has done a Fantastic job in educating the consumer in the operation of the teller. Do not be afraid to use these there will be a friendly face on the Monitor to help you out and the operation is simple.

Thanks, we appreciate really appreciate the feedback and are glad you’ve had a great experience!

I have always felt secure as a member of CCU. Sometimes vendors seem embarrassed when my card won’t clear – but I always know that I am being protected, wherever I am in the country and always think of CCU as an unseen ‘security blanket’. I’ve been with CCU for many years. Nowadays I travel the country. I try to remember to let them know ahead, and the new travel plans form is excellent and easy to use. As an RVer with an 84-gallon fuel tank, it isn’t unusual for me to spend $200 to fill up (not so much now, with the happily reduced oil prices). If I go to a new station, I expect a red flag – a quick call (usually I am dialing the 800 number when they are trying to call me), and all is resolved. Recently I had over $1,000 in RV repairs. By alerting CCU ahead of time of my travel plans, they recognized the seller as being legit.Thank you, CCU, for watching over us!

I’m starting to think more about saving for my future and investing some of my money. I like that with a money market account you would have 24-hour access through online banking. Does this mean you can withdraw the money at any time? Thanks for the information!

Hi April, that is correct, but you must maintain a minimum balance to receive the interest. If you’d like to learn about more investing options please contact any of our offices and they will set you up with a complimentary appointment with a Investment Services Representative.

Love Wedel’s nursery and love lots flowers especially in pots and containers, seems alot less weeding that way exempt around our waterfall garden.

I think if you just moved to an area, starting out renting can be a good idea so you can get acclimated with the area and figure out what part of town you may want to live. Or, depending on the type of job that you may have renting may be a better fit if you get transferred often. The decision to purchase or rent is a big one, and you have provided some great things to think about. Thanks for sharing!

My parents had a great pond and water fountain in their yard. I would love to sit out next to it and read for hours. I live in a condo now, but I do have a two large decks. I have a good size one just outside of my room. I bet I could get a stand alone water fountain that would not take up to much space.

That sounds like a great idea Kody!

I’d like to add a water feature of some sort in my backyard so I can create a more soothing environment. I like your idea of using a pond kit to create a small fountain or waterfall that can circulate water. In the summer this would be fun to have so I could take a quick dip and cool off. Thanks for these awesome ideas!

You are very welcome! We are glad you enjoyed them.