2.15.18

Making sense of beneficiary designations

A will is a good starting point to help ensure that your assets are passed on to your heirs according to your wishes. However, it’s important to specify beneficiaries for financial accounts and insurance policies on the appropriate forms, because they typically supersede instructions in a will.

In any document distributing assets to your heirs, a typical approach would be to name your spouse as primary beneficiary, with your children as contingent beneficiaries. If you are divorced or your spouse has passed away, you might leave your estate in equal shares to your children. (Keep in mind that minor children who are named as beneficiaries should generally have a guardian or trustee to control assets until they are old enough to manage them.)

But what happens in the unfortunate event that one of your children predeceases you? That depends on the language in your will or the beneficiary designation form, so it may be helpful to understand two common Latin terms.

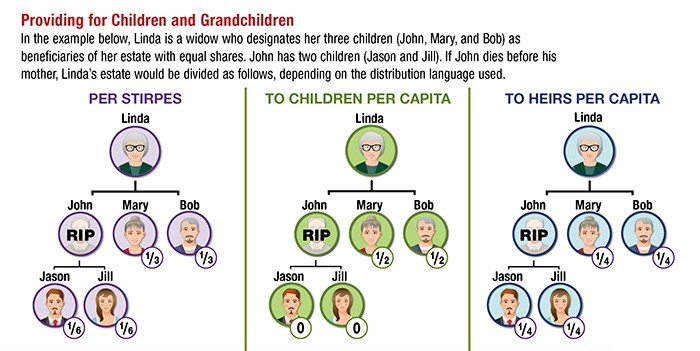

Per stirpes (also called “by representation”) literally means “by the roots,” but it might be clearer to imagine the branches of the family tree. If one of your beneficiaries predeceases you, his or her share would be divided proportionately among his or her heirs upon your death.

Per capita literally means “by the head.” If one of your designated beneficiaries predeceases you, the division of assets would depend on whether you defined the group as to children per capita or to heirs per capita (see below).

If you’d like to take a different approach to investment planning and management, you can meet with one of our CFS* financial advisors. We will review your finances at not cost or obligation, explain your investment options, and help you find the right products for your needs. For your complimentary consultation, please schedule an appointment with a CFS* Financial Advisor at Consumers Credit Union by calling Micki at 269.488.1776. The investment services team can provide strategies to help fit your ever-changing needs.

This information is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc.

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.