1.12.23

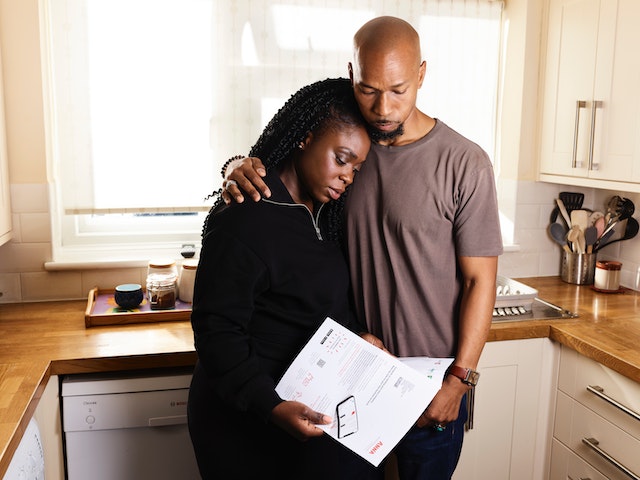

Prepare Now for Future Emergencies

Learn More

Find out more about Investment Services at Consumers Credit Union and meet our CFS* Financial advisors.

Click hereMost communities could be impacted by some type of natural disaster, whether it’s a wildfire, hurricane, tornado, earthquake, or flood.

Here are some tips to help keep your family safe in an emergency and allow you to leave quickly with the items you need most.

Gather important documents that may be difficult or impossible to replace. These are some examples, but you may want other documents as well.

- Insurance policies, banking and financial account information, and account numbers

- Identification such as driver’s licenses, passports, birth and marriage certificates, and Social Security and Medicare cards

- Contracts, wills, deeds, and recent tax returns

- An inventory of your household possessions

In case you are not home when a disaster strikes, consider storing electronic copies of critical documents on a thumb drive or encrypted in the cloud. You might also want to keep the thumb drive and/or original documents in a fireproof safe or a safe-deposit box.

Assemble a disaster kit with basic necessities for your home. Include nonperishable food, bottled water, first-aid supplies, flashlights, an emergency radio, extra batteries, a wrench or pliers to turn off utilities, and a whistle to signal for help. With ongoing concerns regarding COVID-19, make sure to add face coverings, soap, hand sanitizer, and disinfecting wipes to your emergency kit.

Have a list of items to take with you. Start with your home disaster kit and critical documents. Remember to take prescription medications; clothing and bedding for each household member; computer hard drives, laptops, tablets, mobile phones, and chargers; eyeglasses; photos; and special food or other items for children, disabled or elderly family members, and pets.

Plan where you will go if you must evacuate. Will you stay with friends or family in another town, or head to a hotel or a community shelter? Map out a route to your destination as well as an alternate route if roads are blocked or impassable. Identify a safe place to meet if family members become separated. Choose a family member who lives elsewhere to serve as an alternate point of contact. Check the settings on your mobile phones to make sure emergency alerts and warnings are enabled. Practice packing up and leaving your home in 10 minutes or less.

Be sure you have appropriate insurance. The coverage you need depends on the kinds of disasters most likely to affect your home and community. Damage from some natural disasters, such as wildfires, hurricanes, and tornadoes, is generally covered under your homeowners policy, up to policy limits. However, damage from floods and earthquakes typically requires separate policies. Contact your insurance agent to discuss appropriate coverage.

For more information from FEMA, visit ready.gov/be-informed and ready.gov/plan.

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2022

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.

Learn More

Find out more about Investment Services at Consumers Credit Union and meet our CFS* Financial advisors.

Click here