5.10.18

Consider a Roth for tax-free retirement income

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

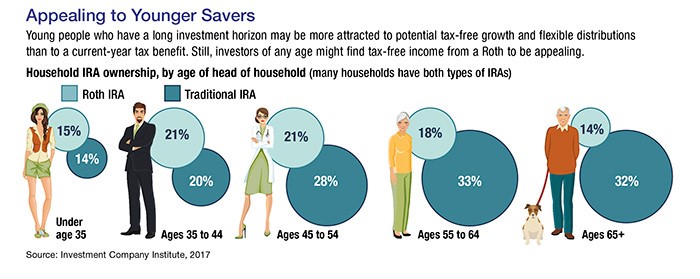

Click hereContributing to a traditional IRA or an employer-sponsored retirement plan may offer a current-year tax benefit by reducing taxable income. However, distributions — including any earnings — are taxed as ordinary income.

By contrast, contributions to a Roth IRA or a designated Roth account in an employer retirement plan do not reduce current income, but qualified withdrawals — including any earnings — are generally free of federal income tax as long as they meet certain conditions. Moreover, contributions to a Roth IRA (but not earnings) can be withdrawn tax-free and penalty-free at any time, for any reason.

Repositioning Your Savings

If you have a traditional IRA but prefer the advantages of a Roth, you can open a Roth IRA and make contributions to either or both accounts, subject to the combined annual contribution limit.

You could also convert all or part of your traditional IRA assets to a Roth IRA. Contributions to an employer’s retirement plan can be converted to a designated Roth account if in-plan conversions are allowed.

Conversions of assets to a Roth account are subject to federal income tax in the year of conversion. Under current tax law and if all conditions are met, the Roth account will incur no further income tax liability for the rest of your lifetime, or for the lifetimes of your designated beneficiaries, regardless of any account growth.

The prospect of a substantial tax bill can be daunting, but paying taxes now may be a worthwhile tradeoff for potential tax-free earnings growth and tax-free income in retirement. And because you do not have to take required minimum distributions (RMDs) from a Roth IRA, you have more flexibility when taking withdrawals.

To make the tax liability of a Roth conversion more manageable, you could spread out smaller conversions over several years. If you change your mind, you can reverse a Roth IRA conversion through recharacterization, generally by October 15 of the year following the tax year of the conversion. You cannot recharacterize an in-plan conversion of assets in an employer-sponsored plan.

Contribution and Distribution Rules

Eligibility to contribute to a Roth IRA phases out at higher income levels. (Income limits also apply for tax-deductible contributions to a traditional IRA if you’re an active participant in an employer plan.) IRA contributions for 2017 can be made up to the April 2018 tax filing deadline; however, employer-plan contributions and Roth IRA conversions for 2017 must be made by December 31.

To qualify for a tax-free and penalty-free withdrawal of earnings, distributions from a Roth IRA or a Roth employer plan account must meet a five-year holding requirement and take place after age 59½ (with some exceptions). The earnings portion of a nonqualified distribution is subject to ordinary income tax and a 10% tax penalty, unless an exception applies.

Assets converted to a Roth IRA can be withdrawn tax-free at any time, but amounts taxed at the time of conversion must meet a five-year holding period for each conversion; if not, withdrawals may be subject to a 10% penalty unless you’re age 59½ or another exception applies.

RMDs from traditional IRAs and employer-sponsored retirement plans (including Roth accounts) must start in the year you turn 70½. Beneficiaries of all IRAs and employer plans generally must start taking RMDs in the year after the original account owner’s death.

It may be wise to consult a tax professional regarding Roth conversions, recharacterizations, and distributions.

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc.

Securities offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. Consumers Credit Union are not registered as a broker-dealer. Registered representatives of LPL offer products and services using Consumers Credit Union, and may also be employees of Consumers Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consumers Credit Union. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Consumers Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Consumers Credit Union for these referrals. This creates an incentive for Consumers Credit Union to make these referrals, resulting in a conflict of interest. Consumers Credit Union is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click here