11.16.17

Tax breaks for college costs

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click hereCollege is expensive, and the costs continue to rise. For the 2016–17 academic year, the average cost of in-state tuition, fees, and room and board at a public university is $20,090. At a private school, the average cost is more than double at $45,370.1

Fortunately, the federal government offers tax benefits that can help ease the financial strain. These tax provisions apply to tuition and fees required for enrollment or attendance, but not for room and board expenses. You cannot take more than one education tax benefit for the same expense or for the same student during a tax year.

Qualified expenses may be paid by the parents, the student, or even a third party. In order for parents to claim the expenses on their federal tax return, the student must be claimed as an eligible dependent. If the student is not claimed as an eligible dependent on anyone else’s return, the student may claim the expenses. A credit reduces your tax liability dollar for dollar, whereas a deduction only reduces your taxable income.

Education Credits and Deductions

American Opportunity Tax Credit — a maximum annual credit of $2,500 for each eligible student’s first four years of undergraduate education. It is calculated as 100% of the first $2,000 of qualified expenses plus up to 25% of the next $2,000 of such expenses. In addition to tuition and fees, the credit may be applied toward expenses for books, supplies, and equipment required for attendance. The student must be pursuing a degree and enrolled at least half-time for one academic period during the tax year. If the credit reduces tax liability to zero, up to 40% of the credit ($1,000) is refundable.

Lifetime Learning Credit — a nonrefundable credit limited to $2,000 per year (20% of the first $10,000 of qualified tuition and fees), per tax return, even if you have multiple students in the household. It applies to all years of post-secondary education, so the credit can be used for graduate school or for undergraduate education after the student uses all four years of the American Opportunity Tax Credit. It also applies to job-development courses even if the student is not pursuing a degree.

Tuition and Fees Deduction — an “above-the-line” tax deduction of up to $4,000 for qualified tuition and fees (scheduled to expire at the end of 2016 unless Congress takes action). The deduction is typically used for a student who is not eligible for an education tax credit.

Determining Qualified Expenses

If you paid tuition and fees during a tax year, you should receive Form 1098-T, Tuition Statement, by January 31 of the following year. Generally, you must reduce the amount of qualified expenses shown as paid or billed on the form by the amount of tax-free educational assistance, such as grants or scholarships. However, if scholarships or grants are reported as income on the student’s return and the funds may be used for nonqualified expenses (such as room and board), they do not have to be subtracted from qualified expenses on the parents’ return.

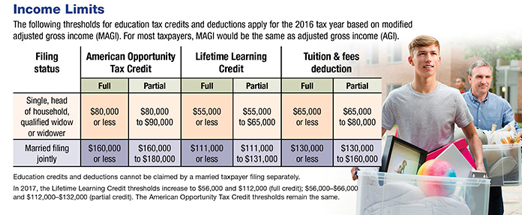

Education credits and deductions are subject to income limits (see chart). If you have questions about the appropriate treatment of educational expenses on your return, be sure to seek advice from a tax professional.

1) College Board, 2016

This information is not intended as tax or legal advice, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek tax or legal advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2017 Broadridge Investor Communication Solutions, Inc.

Securities offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. Consumers Credit Union are not registered as a broker-dealer. Registered representatives of LPL offer products and services using Consumers Credit Union, and may also be employees of Consumers Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consumers Credit Union. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Consumers Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Consumers Credit Union for these referrals. This creates an incentive for Consumers Credit Union to make these referrals, resulting in a conflict of interest. Consumers Credit Union is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click here