1.31.23

Tempted to Buy Now, Pay Later?

Understand the risks of installment payments before you click to agree.

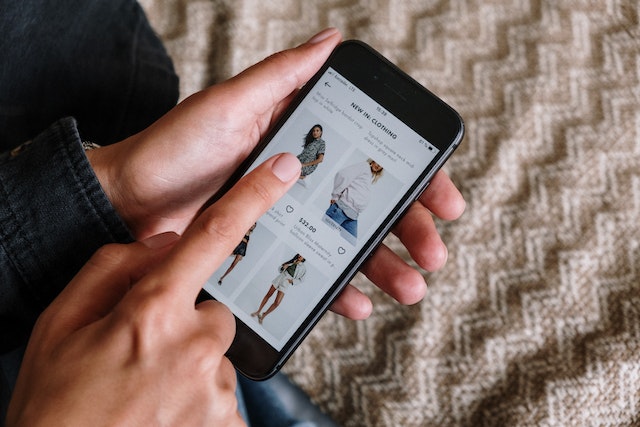

Picture this: you’re shopping online and just below the item you’ve long wanted, you see the $249 price. But then you notice “Or 4 payments of $62.25.” At first glance, it may seem like a no-brainer to get the item right away and pay over time with no interest. However, before you choose a Buy Now, Pay Later plan, make sure you understand the risks.

Buy Now, Pay Later (BNPL) is a loan

In reality, BNPL is a loan. If your payment is tardy you’ll be on the hook for a late payment. Depending on the service provider, the fee could be $1, $10 or even 25% of the full purchase price. While BNPL loans typically carry zero interest, merchants may charge a fee for the service. Be sure to read all the fine print before you agree to a BNPL option.

Consider how BNPL will affect your budget

Before agreeing to a BNPL purchase, consider how the purchase will affect your budget and overall debt.

Most likely BNPL means making four payments over six weeks; 25% today, 25% in two weeks, 25% in four weeks and 25% in six weeks. BNPL typically allows you to make payments on a debit or credit card.

While it’s easy to click and sign up for four payments, it may not be so easy to pay off the BNPL loan.

Before you agree to BNPL, ask yourself: If I can’t afford the full price today, can I really afford the full price over the next six weeks? Stopping to consider this question gives you time to determine how the purchase could affect your overall budget.

Understand how refunds are handled

When you use BNPL you bring a third party into the transaction. Instead of just you and the merchant, now it’s you, the merchant and the financing service. Make sure you understand how refunds are handled before buying in case you need to return the item.

Many BNPL purchases are unnecessary

According to C+R Research, the average number of items BNPL users are currently paying for in installments is 3.8, and their debt averaged $883. What’s more, 59% say they purchased an unnecessary item that they otherwise couldn’t afford.

BNPL makes purchases for everything from fashion and food to tech and travel easier, but it also makes it easier to overspend. Avoid unnecessary spending by asking yourself if you’d buy the item if you had to immediately pay full price. No matter how you divide up the payments, the money is still coming out of your pocket.

BNPL won’t help your build your credit score (but it could hurt it!)

The typical six-week term of a BNPL loan doesn’t allow enough time for financial services to report your payment behavior to the credit bureaus. Therefore, BNPL purchases won’t help you improve your credit score. However, if you fail to pay back a BNPL loan on time, the finance service may report the delinquency, which could damage your credit score.

One way to make sure your purchases and payments help build your credit score is by using a Consumers credit card. Credit cards should also be used responsibly and not used to fund unnecessary purchases. Credit card activity that shows a pattern of responsible spending and timely repayment will help boost your credit score.

Federally insured by NCUA