7.19.18

Why Hold Money Market Mutual Funds?

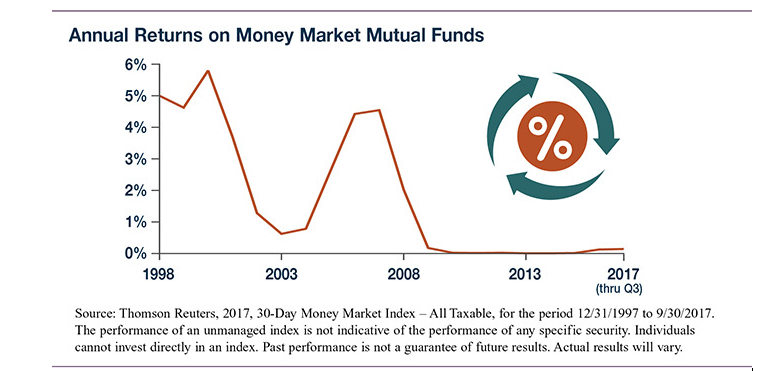

After six years of near-zero returns, the yield on money market mutual funds began to edge upward in 2016, with 30-day taxable funds returning 0.13% for the year. This may not sound like much, but it’s a big jump from the 0.01% to 0.03% yield during the 2010 to 2015 period.

The uptick continued in 2017, with a 0.15% return for the first nine months of the year (see chart). Even with the recent increase, which reflects the Fed’s efforts to raise short-term rates, the return on these mutual funds is so low that it might not seem worth investing. Yet at the end of Q3 2017, investors held more than $2.7 trillion in money market funds.1 What’s the appeal with such a low return? In two words: stability and liquidity.

Cash Alternatives

Money market funds are mutual funds that invest in cash-alternative assets, usually short-term debt. They seek to preserve a stable value of $1 per share and can generally be liquidated fairly easily. Money market funds are typically used as the “sweep account” for clearing brokerage transactions, and investors often keep cash proceeds in the fund on a temporary basis while looking for another investment. They can also be useful to keep emergency funds.

For long-term investing, however, money market funds are a questionable choice. You might keep some assets in these funds to balance riskier investments, but low yields can expose your assets to inflation risk — the potential loss of purchasing power — along with the lost opportunity to pursue growth through other investments. This could change if interest rates continue to rise, but the Fed seems committed to a gradual approach that will keep rates relatively low for some time.2

Money market funds are neither insured nor guaranteed by the Federal Deposit Insurance Corporation or any other government agency. Although money market funds seek to preserve the value of your investment at $1 per share, it is possible to lose money by investing in such a fund.

Mutual funds are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.

1) Investment Company Institute, 2017

2) Federal Reserve, 2017

This information is not intended as tax, legal, investment, or retirement advice or recommendations, and it may not be relied on for the purpose of avoiding any federal tax penalties. You are encouraged to seek advice from an independent professional advisor. The content is derived from sources believed to be accurate. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was written and prepared by Broadridge Advisor Solutions. © 2018 Broadridge Investor Communication Solutions, Inc.

* Non-deposit investment products and services are offered through CUSO Financial Services, L.P. (“CFS”), a registered broker-dealer (Member FINRA/SIPC) and Registered Investment Advisor. Products offered through CFS: are not NCUA/NCUSIF or otherwise federally insured, are not guarantees or obligations of the credit union, and may involve investment risk including possible loss of principal. Investment Representatives are registered through CFS. Consumers Credit Union has contracted with CFS to make non-deposit investment products and services available to credit union members.