9.11.25

College Corner

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click hereAs Summer draws to a close and pool noodles everywhere breathe a sigh of relief, it’s time to consider one of the most exciting milestones for many families: Attending Higher Education.

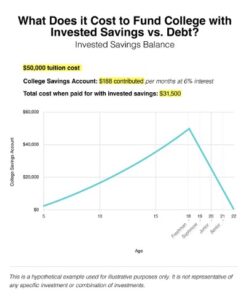

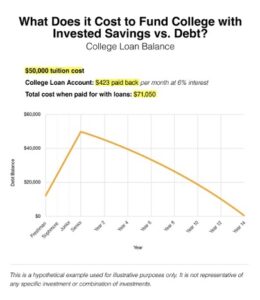

Savings or Debt?

The transition to college is a significant milestone, and many ways exist to address the cost. Savings, scholarships, and grants are all options, but some have also asked if educational loans are viable. That depends on several factors, but first, it’s crucial to understand what’s at stake. Let’s look at the particulars.

Parent Student Loans

A parent student loan is a tool for parents to secure funds for their child’s college education. These can be either government-backed via the U.S. Department of Education, known as Direct PLUS loans, or from private lenders. Each has pros and cons, and considering the loan in the context of your overall financial strategy is crucial, including your preparation for retirement.1

While parent student loans can function as a lifeline in bridging the gap between college costs and available funds, they are only one choice to consider.

Federal Loans

Federal loans may be easier to secure with fewer strict credit requirements than private student loans, based on factors like credit scores and income. On the other hand, private loans may offer lower interest rates to borrowers with excellent credit.2

Private Loans

Taking the private loan route provides easier access to funds and flexibility. However, these benefits also come with risks, such as higher interest rates and fees or limited repayment options compared to other federal student loans.

Thus, if you decide to take a loan to simplify the process of paying for your child’s college education, reviewing the loan in the context of your overall financial situation is crucial.

In other words, all the positive financial habits you have already employed apply here. Think of this as just one more way you’re modeling positive financial habits for your intrepid learner.

One could even take out a loan expecting the college student to help pay it back. Depending on how much control your student will have over the funds, this can also help set clear expectations for spending the funds and help avoid misuse or unforeseen mishaps.

But wait, there’s more!

Consider alternative options such as scholarships, work-study programs, and even having your child take a federal loan independently (this can result in lower interest rates and more flexible payment options). All of these may help manage the financial cost of higher education.

Although many of us can simply pay for college, it may not always fit with a family’s overall financial approach. Exploring loan choices for parents and students can give you a better perspective of what’s available. For parents, deciding to take a loan requires evaluating their overall retirement goals, financial position, and estate management. Most students have time to help resolve loan issues. For parents, time is a key variable in the overall evaluation.

Resource Spotlight

CollegeSimply’s search features comprehensive rankings and authentic student reviews. With a database of over 3,500 U.S. schools, this interactive tool can filter, sort, and compare choices, even mapping them to match your educational objectives. It’s worth a look! Give it a try by navigating to: www.collegesimply.com

1Edvisors.com, November 2023

2Studentaid.gov, 2024

3Collegeboard.org, 2024

4Studentaid.gov, 2024

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG, LLC, is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright FMG Suite.

Securities offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. Consumers Credit Union are not registered as a broker-dealer. Registered representatives of LPL offer products and services using Consumers Credit Union, and may also be employees of Consumers Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consumers Credit Union. Securities and insurance offered through LPL or its affiliates are:

| Not Insured by NCUA or Any Other Government Agency | Not Credit Union Guaranteed | Not Credit Union Deposits or Obligations | May Lose Value |

Consumers Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Consumers Credit Union for these referrals. This creates an incentive for Consumers Credit Union to make these referrals, resulting in a conflict of interest. Consumers Credit Union is not a current client of LPL for brokerage or advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.

The LPL Financial registered representatives associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Learn more

Find out more about Investment Services at Consumers Credit Union, available through LPL Financial (LPL), and meet our LPL Financial Advisors.

Click here