4.25.23

Digital Envelope System: The Safer Way to Budget

You’ve likely seen it on TikTok—Dave Ramsey’s envelope method of saving money is making a major comeback and gaining high-profile news coverage. But what is it? Let’s take a deeper look.

What is the envelope system?

The Dave Ramsey envelope system has long been a staple for many focused budgeters. While the premise is quite simple, it can make a major impact on your budget. Here’s how it works:

- Identify common items that you typically spend your money on after your major, recurring bills are paid. Think of things like groceries, restaurants, entertainment, gas, clothing, gifts, etc.

- Grab a stack of envelopes and label one for the areas you identified and determine a spending amount for each. Then fill that envelope with the allotted cash.

- Spend only the money that you’ve budgeted for each area every month.

How will you handle the cash?

The envelope method is effective because it forces you to stay on track, holds you accountable and makes it difficult to overspend, but is it actually safe to carry around all that cash? Some would say having envelopes stuffed with bills on hand could make you vulnerable to loss and theft. So, you may be thinking … is there another way to implement the system?

How to budget safely with technology

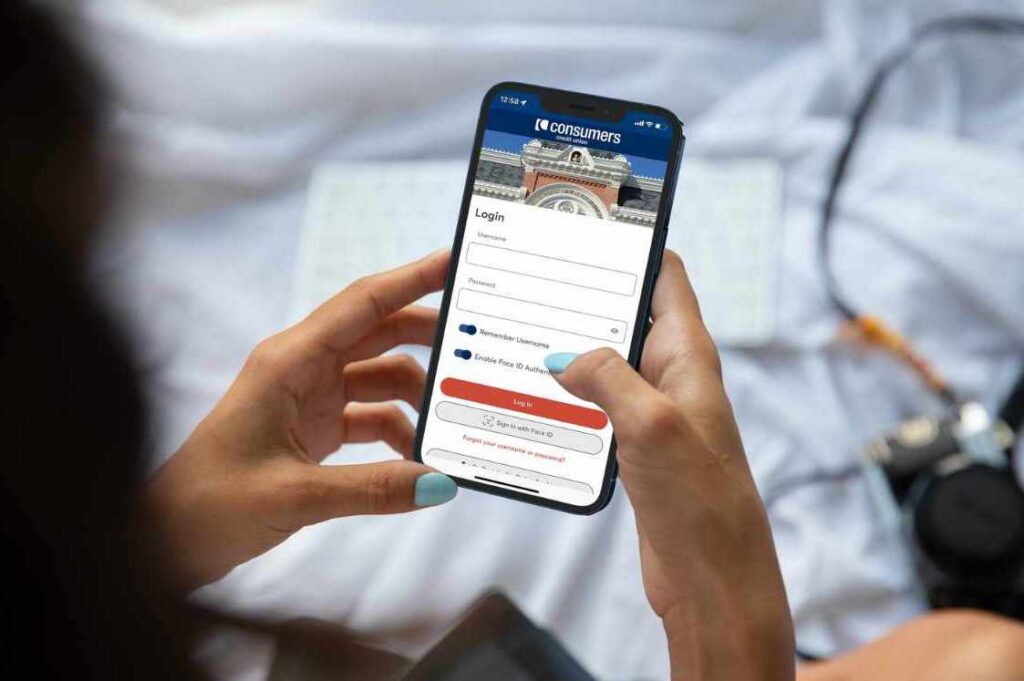

Fortunately, we’re here to keep your money safe and help you with all your budgeting needs. The Consumers digital envelope system is an effective and safe method of budgeting that upholds the premise of Dave Ramsey’s system, while also utilizing our convenient and secure technology.

Rather than organizing your money into physical envelopes, consider opening separate Consumers savings accounts for each of your identified spending areas. We make it easy to open accounts online directly through our 5-star mobile app and online banking. From there you can quickly transfer money into each of your separate accounts.

When it’s time to pay a bill or make a purchase, simply transfer the money to your checking account from the correct savings account. For example, right before you go to the grocery store, transfer the money from your grocery savings account into your checking account. Then all you have to do is monitor the items you’re adding to your cart and swipe your debit card to complete your purchase.

Remember, if you’re about to spend more than you transferred, you should put some items back to avoid breaking your budget and potentially overdrafting your account.

Did you spend less than you thought? If you consistently spend less than the amount you budgeted for, consider re-evaluating your budget. If it’s an infrequent event, put the money back into emergency savings or pay down a bill.

With the digital envelope system, you can keep your money safe while sticking to your budget.

And if you’re really interested in hands-free budgeting, consider setting up automatic transfers to move your money directly to your designated budget savings accounts or utilize Consumers Bill Pay, another convenient tool that automatically pays your bills each month.

Federally insured by NCUA